Tax Rate In England 2021 . Income tax on earned income is charged at three rates: The income tax rates and personal allowances in england are updated. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. For historical rates, find out more about income tax rates and allowances for previous tax years. The basic tax rate for england, northern ireland wales for. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. Corporation tax rates and limits. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The basic rate, the higher rate and the additional rate. England personal income tax tables in 2021.

from federalwithholdingtables.net

England personal income tax tables in 2021. For historical rates, find out more about income tax rates and allowances for previous tax years. The basic tax rate for england, northern ireland wales for. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. Corporation tax rates and limits. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The basic rate, the higher rate and the additional rate. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The income tax rates and personal allowances in england are updated. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your.

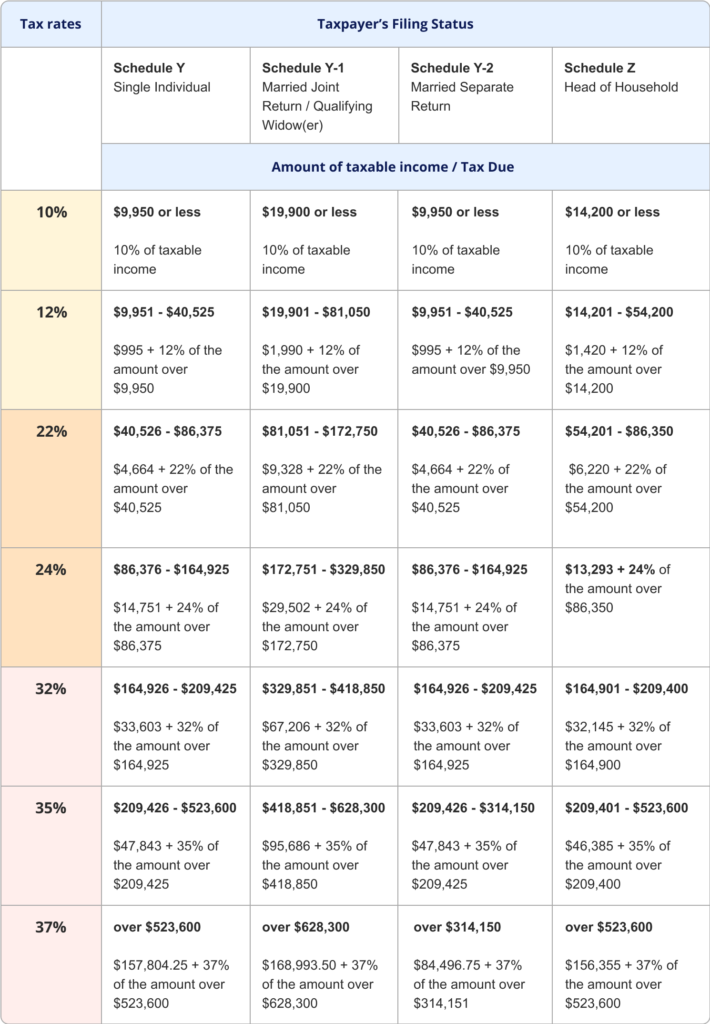

IRS Tax Charts 2021 Federal Withholding Tables 2021

Tax Rate In England 2021 The basic tax rate for england, northern ireland wales for. The income tax rates and personal allowances in england are updated. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The basic tax rate for england, northern ireland wales for. For historical rates, find out more about income tax rates and allowances for previous tax years. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. Corporation tax rates and limits. England personal income tax tables in 2021. The basic rate, the higher rate and the additional rate. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. Income tax on earned income is charged at three rates:

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Tax Rate In England 2021 The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. For historical rates, find out more about income tax rates and allowances for previous tax years. The basic rate, the higher rate and the additional rate. The income tax rates and personal allowances in england. Tax Rate In England 2021.

From www.taxresearch.org.uk

Why do the least well off still have the highest tax rate in the UK? Tax Rate In England 2021 Corporation tax rates and limits. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. The basic rate, the higher rate and the additional rate. The income tax rates and personal allowances in england are updated. The income tax rates and thresholds below are for. Tax Rate In England 2021.

From bench.co

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench Tax Rate In England 2021 For historical rates, find out more about income tax rates and allowances for previous tax years. The income tax rates and personal allowances in england are updated. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The basic rate, the higher rate and the additional rate. This paper sets out direct tax rates and principal tax. Tax Rate In England 2021.

From uk.news.yahoo.com

Council tax increase Map shows areas with highest bills in England Tax Rate In England 2021 England personal income tax tables in 2021. For historical rates, find out more about income tax rates and allowances for previous tax years. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. The personal allowance rate for 2021 to 2022 has been corrected to. Tax Rate In England 2021.

From taxhelp.uk.com

HMRC 2021 Paper Tax Return Form Tax Rate In England 2021 The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. The basic rate, the higher rate and the additional rate.. Tax Rate In England 2021.

From www.bbc.co.uk

Council tax bills in England to rise an average of 4.5 BBC News Tax Rate In England 2021 Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The income tax rates and personal allowances in england are updated. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. For historical rates, find out more about income tax. Tax Rate In England 2021.

From www.simmons-simmons.com

Autumn Statement 2022 HMRC tax rates and allowances for 2023/24 Tax Rate In England 2021 Corporation tax rates and limits. For historical rates, find out more about income tax rates and allowances for previous tax years. England personal income tax tables in 2021. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The income tax rates and personal allowances in england are updated. The basic rate, the higher rate and the. Tax Rate In England 2021.

From www.bbc.co.uk

UK economy rebounds with fastest growth since WW2 BBC News Tax Rate In England 2021 This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. The basic rate, the higher rate and the additional rate. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your.. Tax Rate In England 2021.

From www.bbc.com

What taxes will you pay in Scotland? BBC News Tax Rate In England 2021 The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. Income tax on earned income is charged at three rates:. Tax Rate In England 2021.

From uk.finance.yahoo.com

Typical council tax bill in England ‘set to increase by nearly £65 in Tax Rate In England 2021 The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. Income tax on earned income is charged at three rates:. Tax Rate In England 2021.

From haysmacintyre.com

Scottish Tax Rates update haysmacintyre Tax Rate In England 2021 The basic tax rate for england, northern ireland wales for. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The basic rate, the higher rate and the additional rate. England personal income tax tables in 2021. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The income tax rates and. Tax Rate In England 2021.

From tradingeconomics.com

United Kingdom GDP 19602020 Data 20212023 Forecast Historical Tax Rate In England 2021 Corporation tax rates and limits. The income tax rates and personal allowances in england are updated. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. England personal income tax tables in. Tax Rate In England 2021.

From standard-deduction.com

Standard Deduction For 202122 Standard Deduction 2021 Tax Rate In England 2021 The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The basic tax rate for england, northern ireland wales for. Corporation tax rates and limits. The income tax rates and personal allowances in england are updated. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. For historical rates, find out more. Tax Rate In England 2021.

From www.fkgb.co.uk

UK Tax Allowances and Tax Rates for 2022/23 Tax Year and Future Years Tax Rate In England 2021 For historical rates, find out more about income tax rates and allowances for previous tax years. This paper sets out direct tax rates and principal tax allowances for the 2021/22 tax year, as confirmed in the 2021 budget on 3 march. The income tax rates and personal allowances in england are updated. The basic tax rate for england, northern ireland. Tax Rate In England 2021.

From www.relakhs.com

All in one guide to Important Budget 202122 Proposals Tax Rate In England 2021 Corporation tax rates and limits. Income tax on earned income is charged at three rates: The basic rate, the higher rate and the additional rate. For historical rates, find out more about income tax rates and allowances for previous tax years. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The basic tax rate. Tax Rate In England 2021.

From www.pdfprof.com

business tax brackets 2020 Tax Rate In England 2021 England personal income tax tables in 2021. The basic rate, the higher rate and the additional rate. The basic tax rate for england, northern ireland wales for. Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. Income tax on earned income. Tax Rate In England 2021.

From blog.churchillmortgage.com

Filing Your 2021 Taxes What You Need to Know Tax Rate In England 2021 Since 2015/2016 the corporation tax rate has been unified for all company sizes, eliminating the. Corporation tax rates and limits. England personal income tax tables in 2021. The basic tax rate for england, northern ireland wales for. The income tax rates and personal allowances in england are updated. This paper sets out direct tax rates and principal tax allowances for. Tax Rate In England 2021.

From www.bbc.com

General election 2019 How much tax do British people pay? BBC News Tax Rate In England 2021 England personal income tax tables in 2021. The personal allowance rate for 2021 to 2022 has been corrected to £12,570. The income tax rates and personal allowances in england are updated. The income tax rates and thresholds below are for employees in england (en), you can use this income tax calculator for 2021 to calculate your. This paper sets out. Tax Rate In England 2021.